Financing utopia

Hedonistic mechanism design

February 16, 2015 — November 12, 2021

On more equitable ways to get capital-intensive risky things done. Weird stakeholder models. Worker owned firms. Der Mittelstand. Should probably include Prediction market and/or mechanism design angles.

For descriptive stuff, see finance, descriptive. For actual strategies in already-existing markets, portfolio theory.

1 Worker-owned institutions

See Founders and workers.

2 Georgism

Well, this is a thing, apparently: r/Georgism

Georgism (otherwise known as geoism) is an economic philosophy holding that the economic value derived from land, including natural resources and natural opportunities, should belong equally to all residents of a community, but that people own the value that they create themselves.

Most Georgists support:

- A broad-based land value taxation scheme, either to mostly or entirely replace existing harmful taxes on income, consumption, and corporations.

- The social redistribution of this revenue either directly, through a Citizens’Dividend, or indirectly, through government programs, to citizens.

- Some (but not all) forms of market intervention by the state.

- The abolition of tariffs, quotas, patents, and other barriers to trade and commerce.

The Georgist paradigm crosses the left-right political divide. This means that there are statist, anarchist, progressive, and conservative Georgists.

so I suppose this impinges upon intellectual property as well as real estate pollution.

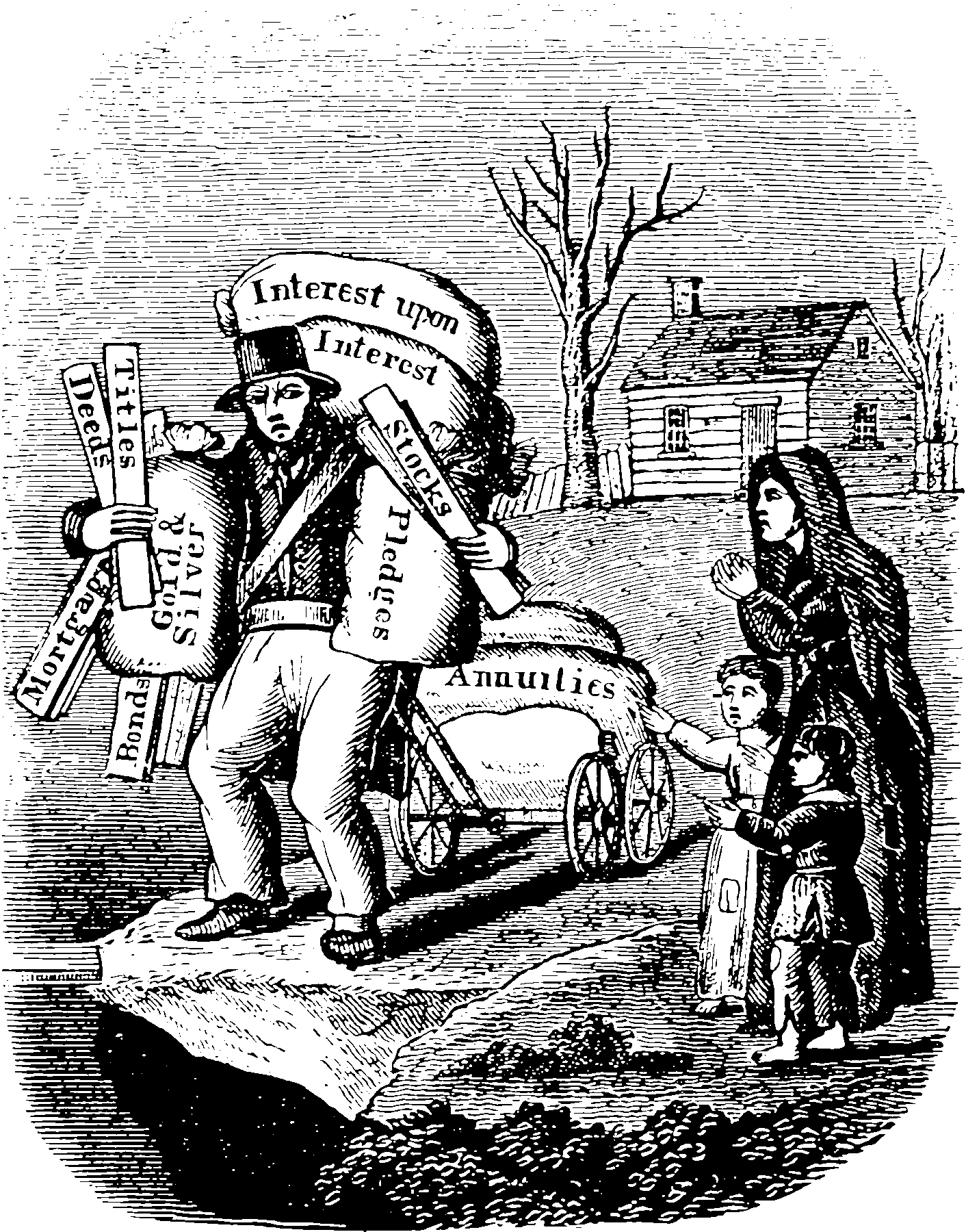

3 Crowd lending

A placeholder to remind me to return to investigating the various models here. Various models here. TBC.

I am indebted to Annette Loudon for mentioning Savings pools in this context.

A platform through which the crowd can lend money to growing businesses that are delivering impact. […]

Impact SMEs post deals for the capital they need to the crowd.

Lenders in the crowd choose the deals they support because of the business, the terms and the impact.

Borrowers chase their business and impact goals, and repay their lenders an agreed interest rate after an agreed time frame.

The above models tend towards impact investing. I guess more broadly we refer to alternative non-impact models as “crowd equity”:

We’ve worked with the team at Cooley to create an investment instrument that has elements of both debt and equity. Debt in that we will not be purchasing equity initially, but, unlike debt, there is no maturity date, no collateralization of assets and no recourse if it’s never paid back. The equity element will only become a factor if the participating company chooses to raise a round of financing or sell out to an acquiring company. We don’t have a clever acronym or name for this instrument yet, but I’m sure we’ll come up with something great.

This instrument gives us a lot more flexibility to work with different types of companies than the Delaware C-Corps most commonly funded by VCs. It also facilitates the two elements of the indie.vc terms that were most important to us and to founders: cash distributions and contingent equity conversion.

equitise and Tsimilar: Equity crowdfunding for private companies in Australia/NZ. I kind of like that this exists but also… why would you rationally take on the higher risk of non-listed firms? Serious question.

4 Blockchain precarity

Taylor Pearson, Blockchain man mashes up utopian freelance precarious market-ism with tech trends, but shies short of calling it a manifesto because it is notionally about how people will talk about our micropayment future, not what will actually happen.

The Balkanization that began in the late 20th century with the fracturing of post-colonial Africa and post-USSR Eastern Europe will continue through the 21st century. The city-state will become the organizing unit of global society.

Much like the Catholic Church today, Nation-States will continue to play a meaningful, but secondary role. […]

Instead of a paycheck, The Blockchain Man’s income will be a large number of micropayments from past projects. The tokens from different projects will appreciate or depreciate based on the success of the project (and perhaps pay dividends). […]

Where the Organization Man’s world was defined by The Organization, The Blockchain Man’s world will be defined by markets.

Even something as simple as commuting will be market driven.

What happens when you mash blockchains, Uber and Self-driving cars together? The self-owning car.

A car that pays for its lease, its insurance, and its gas, by giving people rides. A car that is not owned by a corporation. It is a corporation. The car exists as an autonomous financial entity, potentially with no human ownership.

5 Impact investing

Placeholder.

6 Incoming

- The Grocery Store Where Produce Meets Politics

- What Co-ops and DAOs Can Learn From Each Other

- [Decentralized autonomous organization](https://en.wikipedia.org/wiki/Decentralized_autonomous_organization#:~:text=A%20decentralized%20autonomous%20organization%20(DAO,words%20they%20are%20member%2Downed)