Innovation

Side order of progress studies now I guess

July 27, 2014 — February 6, 2024

I am especially interested in modeling how technology makes profound changes to the rules of the game, not just marginal changes in some parameters; So not, say, residual stochastic shocks (in the “Real Business Cycle” models), or as the slope of a marginal cost of production curve (in textbook microeconomics). That is, technological innovation that leads to a qualitative, rather than incremental, change in the state of play — respecting that a lot of marginal changes might indeed lead to major qualitative changes.

In recognition of that emphasis, I briefly called this entry “disruptive technology” instead of mere “innovation”, but then I felt like a TED speaker and woke up sweating in the night and changed it.

This is a vibrant area at the moment, readily disrupting itself. Brr. This notebook will probably explode soon and sporulate, leaving behind some smaller ones.

1 To consider

This concept, innovation, is at the very limit of modelability, surely?. The introduction of a new technology has many components, from social uptake, to supply chains, to the discovery process. The unexpected interactions with the other technologies out there. The internal combustion engine changed more than just transit times. The computer network altered more than just mail delivery times.

The cascade of effects from any one alteration is, it is likely, unknowable in advance, but might have some regularities, or at least some kind of underlying set of distributions as a stochastic process — some kind of branching process perhaps? Fixation processes, by analogy with evolutionary theory?

2 Where did the industrial revolution come from?

Gregory Clark and Julia Galef in podcast conversation: What caused the industrial revolution?:

the timing in 1770 in Britain makes it very, very difficult to explain the industrial revolution. The reason for that is that Britain at that time was institutionally a very stable society, and essentially had very little institutional change in the previous 80 years. When you’re trying to explain this event, it’s occurring against the kind of unchanged background of a society… with stable institutions. Very small government that mainly exists to fight more abroad. You have very stable wages within the society, they’re really not changing, the cost of capital was not changing. [..] It’s an economic environment which just looks very flat. Suddenly, in the middle of all of this, you’ve got this transforming event occurring.

3 Innovation networks

A well documented example of this is the “Product space” model, due originally to Hidalgo and Hausmann, and made purportedly more rigorous by Caldarelli et al.

Considers products and nations in a bipartite graph, and does various network statistics upon it.

Attempts to be predictive about the “natural level” of a country’s GDP.

(c.f. Felix Reed-Tsochas’ affinity for such graphs, har har) Note that there is an implicit third part in the graph, to whit “capabilities”, which represent infrastructure to manufacture products.

Frank Schweitzer et al have a similar notion of inter-firm R&D networks which may be related? See references.

random idea: Estimating number of SKUs as a surrogate for divisions of a modern economy a la Beinhocker (lots of research into this because of Long Tail theories, though the primary data is rarely included — might chase this.)

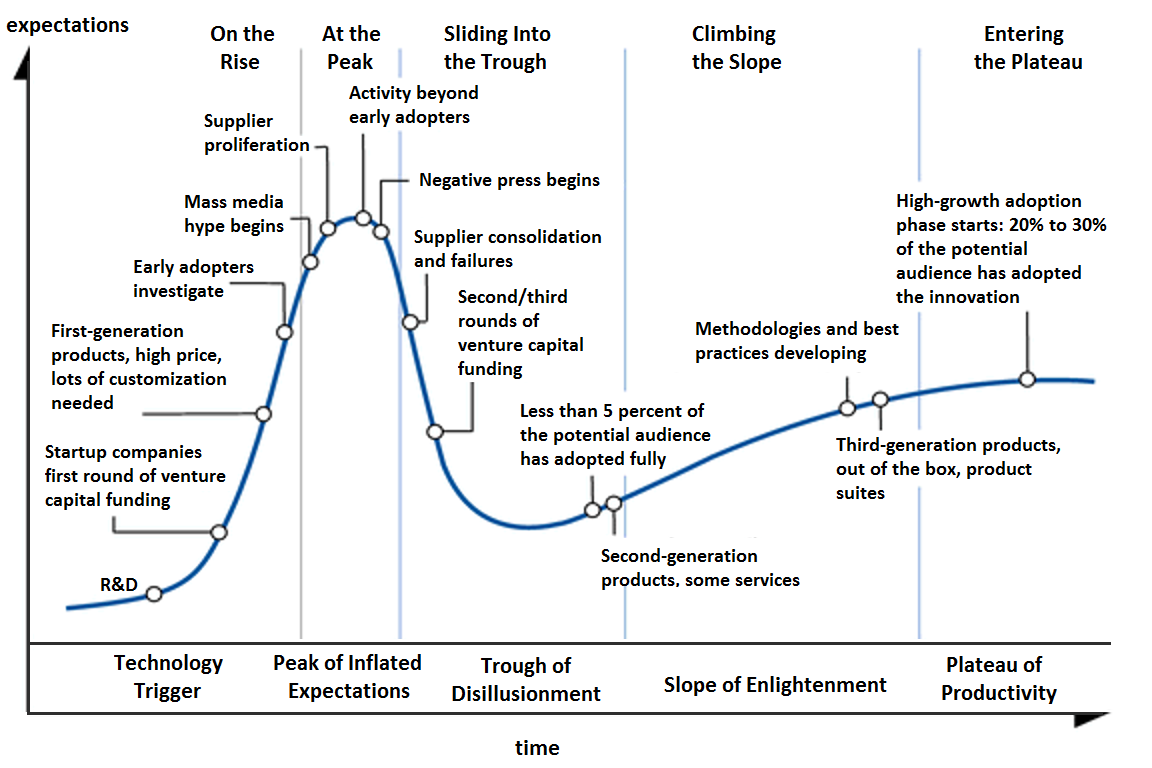

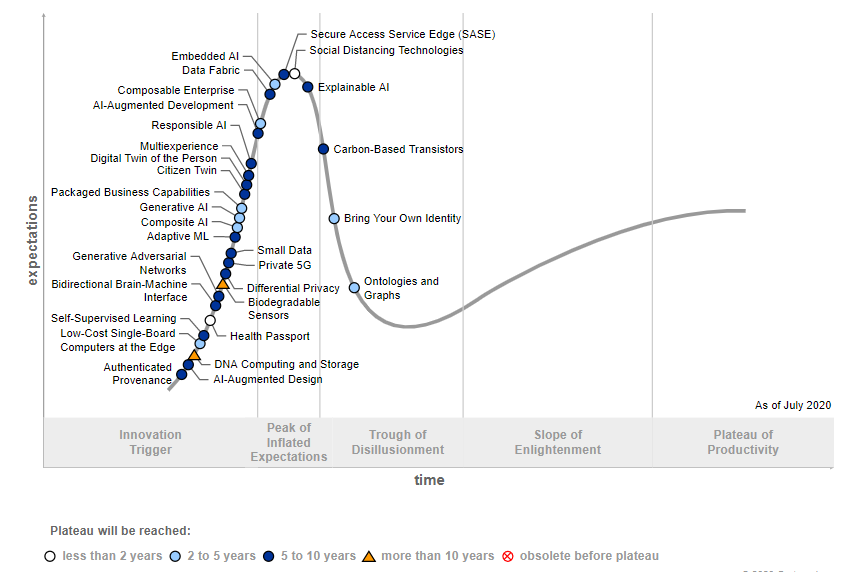

4 Hype cycle

This is a cute model of certain stylised types of overhypeing.

The hype cycle itself is presumably on the plateau of productivity right now since Gartner has a steady business producing diagrams based on it.

5 Marginal returns on research

See Kevin Bryan’s paper reviews, especially Models of Innovation I: The Patent Race has a lot of papers discussed which I should file one day > I’ve been going through some old literature on innovation again as part of a current project, so I figured I ought put up a little review of this literature. I’ll cover five strands: the patent race, the partial equilibrium/auction, the quality ladder, sequential innovation a la Scotchmer and Green, and bandit experimentation.

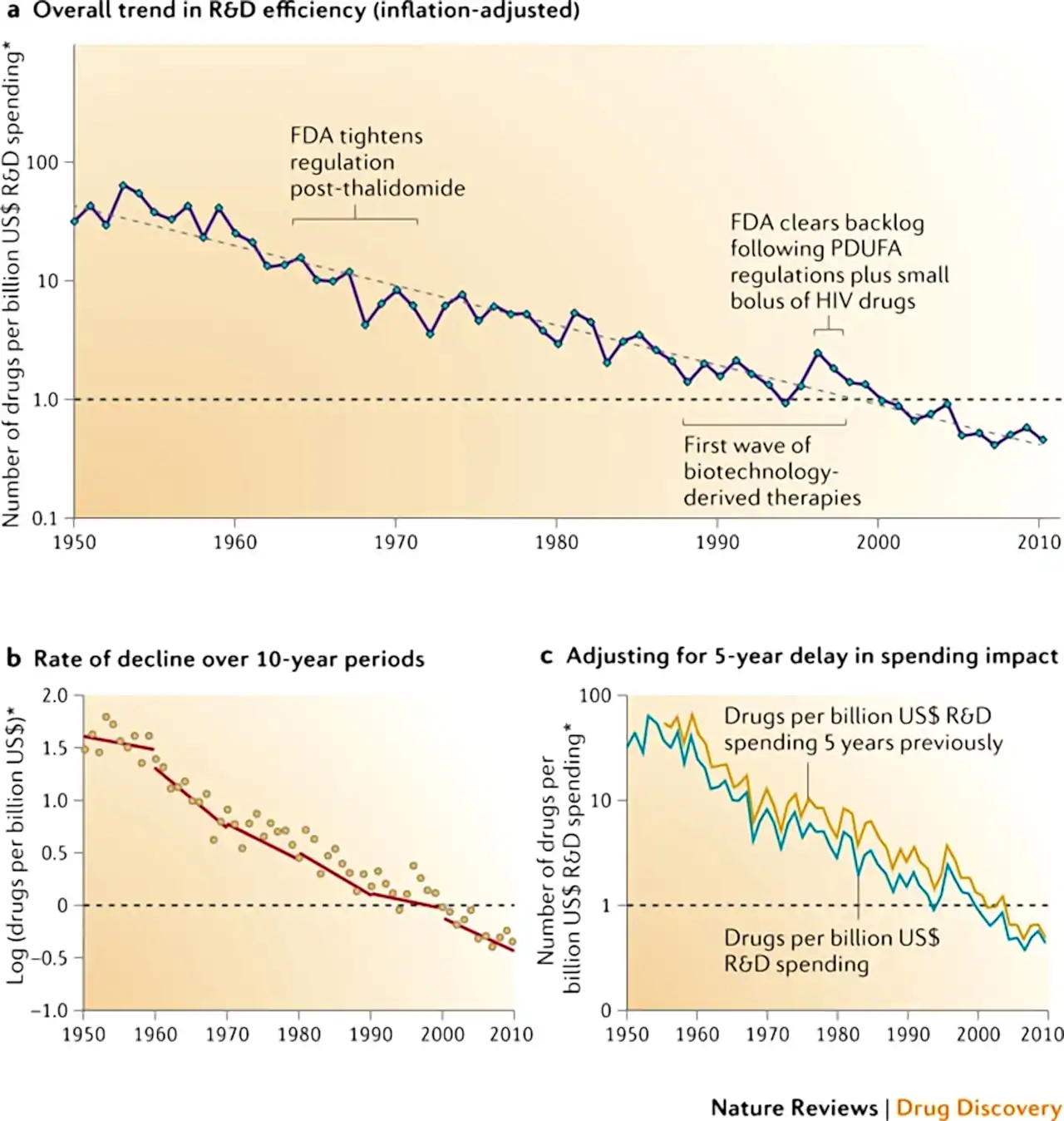

Moore’s law versus Eroom’s law governing trends in marginal research productivity. What does the paucity of new drugs mean? Is this the same as the problem in science? The difficulties form the basis of François Chollet’s arguments against the likelihood of a hard AI singularity and The Singularity is not coming relate this to the question of a technological singularity.

Is science slowing down? Experiencing diminishing returns? Are good ideas getting harder to find? (Bloom et al. 2020)

Is it just me, or does this resemble a maximal statistic, or perhaps a rarefaction curve? See Scannell et al. (2012).

-

Do technological improvements primarily result in lower prices for consumers or in higher profits for producers? If producers are able to capture (or appropriate) most of the social returns to innovation, then profits will rise and prices will fall relatively little.

How much of the profits from a new technology are captured by innovators will vary greatly across industries. For sectors where knowledge is in the public domain, such as weather forecasting, the new knowledge cannot be appropriated and productivity improvements are passed on in lower prices. In other industries with well-defined products and strong patents, such as pharmaceuticals, producers may be successful in capturing a large fraction of social gains in “Schumpeterian profits.”

Danny Crichton, The dual PhD problem of today’s startups:

Software is so democratized today, we forget just how blisteringly difficult almost all other facets of human endeavor are to even start. A middle schooler can build and deploy a web service scalable to millions of people with some lines of code (learned from easily and widely accessible resources on the internet) and some basic cloud infrastructure tools that are designed to onboard new users expeditiously.

Try that with rocketry. Or with pharma. Or with autonomous vehicles. Or any of the interesting new frontiers with green fields that are just sitting there waiting for the taking.

Andreessen Horowitz critiques AI startup hype that claims we have a unicorn factory.

I found that the marginal returns of researchers are rapidly declining. There is what’s called a ‘standing on toes’ effect: researcher productivity declines as the field grows. Because ML has recently grown very quickly, this makes better ML models much harder to find.

His thesis Besiroglu (2020) goes into depth.

Rebranded: Danny Dorling, Slowdown: The End of the Great Acceleration—and Why It’s Good for the Planet, the Economy, and Our Lives..

Via Rob Dunne, Arora et al. (2023):

We study the relationships between corporate R&D and three components of public science: knowledge, human capital, and invention. We identify the relationships through firm-specific exposure to changes in federal agency R&D budgets that are driven by the political composition of congressional appropriations subcommittees. Our results indicate that R&D by established firms, which account for more than three-quarters of business R&D, is affected by scientific knowledge produced by universities only when the latter is embodied in inventions or PhD scientists. Human capital trained by universities fosters innovation in firms. However, inventions from universities and public research institutes substitute for corporate inventions and reduce the demand for internal research by corporations, perhaps reflecting downstream competition from startups that commercialize university inventions. Moreover, abstract knowledge advances per se elicit little or no response. Our findings question the belief that public science represents a non-rival public good that feeds into corporate R&D through knowledge spillovers.

6 Stagnation

Jason Crawford, Technological stagnation: Why I came around

Thiel, P. A. (2014). Zero to one: notes on startups, or how to build the future:

“Thiel begins with the contrarian premise that we live in an age of technological stagnation, even if we’re too distracted by shiny mobile devices to notice. Information technology has improved rapidly, but there is no reason why progress should be limited to computers or Silicon Valley. Progress can be achieved in any industry or area of business. It comes from the most important skill that every leader must master: learning to think for yourself.

Doing what someone else already knows how to do takes the world from 1 to n, adding more of something familiar. But when you do something new, you go from 0 to 1. The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. Tomorrow’s champions will not win by competing ruthlessly in today’s marketplace. They will escape competition altogether, because their businesses will be unique.”

I gather this is re-introducing Austrian economics to the silicon valley age. The sting will be in the policy prescriptions.

Sam Kriss is glum and hyperbolical as always. The Long, Slow, Rotten March of Progress:

None of these start-ups are doing anything new or interesting. Which shouldn’t be surprising: how often does anyone have a really good idea? What you actually get is just code, sloshing around, congealing into apps and firms that exist simply to exist. Uber for dogs, GrubHub for clothes, Patreon for sex, Slack for death, PayPal for God, WhatsApp for the spaceless non-void into which a blind universe expands.

I wonder how well supported is Hartmann, Krabbe, and Spicer (2019):

What is driving the declining quality of innovation-driven entrepreneurship? In this paper, we argue the growing entrepreneurship industry is an important yet overlooked explanation. This rapidly growing industry has transformed the nature of entrepreneurship and encouraged a particular form of low-quality entrepreneurship. It has done so by leveraging the Ideology of Entrepreneurialism to mass-produce and mass-market products that make possible what we term Veblenian Entrepreneurship. This is entrepreneurship pursued primarily as a form of conspicuous consumption. Aside from lowering average entrepreneurial quality, Veblenian Entrepreneurship has a range of (short-run) positive and (medium and long-run) negative effects for both individuals and society at large. We argue that the rise of the Veblenian Entrepreneur has contributed to creating an increasingly Untrepreneurial Economy. That is an economy which superficially appears innovation-driven and dynamic, but is actually rife with inefficiencies and unable to generate economically meaningful growth through innovation.

As someone who has worked in what I cannot call a dotcom exit scam (because it did certain necessary tasks to be legally distinct from a scam and yet not ever enough to plausibly succeed) I am sympathetic to rants about this.

7 Building innovative societies and places

See astroturf and artificial reefs for now.

8 Progress studies

This needs tidying.

Originally (?) proposed by Patrick Collison and Tyler Cowen, We Need a New Science of Progress. The idea invites critique; that is kind of its purpose.

- Shannon Dea, Ted McCormick Can ‘progress studies’ contribute to knowledge? History suggests caution.

- Progress Studies on LessWrong

- How does progress happen?

- Progress Studies: A blog about the causes and consequences of Progress, Economic Growth, Technological Change, and Innovation

- The Moral Foundations of Progress

- Progress Studies: A Discipline is a Set of Institutional Norms

9 Geniuses and eccentrics

See stroppy people.

10 Incoming

Why Remote Work Could Lead to Less Innovation - WSJ (Atkin, Chen, and Popov 2022)

Metacelsus, De Novo

Henrik Karlsson, Escaping Flatland

Industrial Policy, Innovation, and Decline with Ben Landau-Taylor

On expected utility, part 1: Skyscrapers and madmen – Hands and Cities

Matt Clancy, Progress in Programming as Evolution

Intellectual Property systems

Mathematical Model Reveals the Patterns of How Innovations Arise:

So Loreto, Strogatz, and co have modified Polya’s urn model to account for the possibility that discovering a new color in the urn can trigger entirely unexpected consequences. They call this model “Pólya’s urn with innovation triggering.” [..they] then calculate how the number of new colors picked from the urn, and their frequency distribution, changes over time. The result is that the model reproduces Heaps’ and Zipf’s Laws as they appear in the real world

“reveal” is excessive. But it is cute for sure.

Phillip Ball has ideas on What innovation really is

Mariana Mazzucato seems to be interesting.

The Myth of the Myth of the Lone Genius is a little bit angry that narratives about collective endeavour have eclipsed lone genius narratives. There is a lot of terminological wrangling. My opinions, in my own terminology, which might be compatible with the argument and also with the argument this person is attempting to refute, is “geniuses are real, I promise, I have met some. Also, they get stuff done, but in practice they get it done in a social context and sometimes that stuff they get done is crazy and/or useless. Also teams of non-geniuses get stuff done, which can also, to be fair, be crazy and/or useless.” My version lacks pith and invective, though.

Bert Hubert on innovation

How technology loses out in companies, countries & continents and what to do about it

Eric Gilliam, FreakTakes, e.g. A Progress Studies History of Early MIT — Part 1: Training the engineers who built the country

Fiber arts, mysterious dodecahedrons, and waiting on “Eureka!”

Noah Smith, Cutthroat capitalism vs. cuddly capitalism

in 2012, Daron Acemoglu, James Robinson, and Thierry Verdier came out with a paper about the different “varieties of capitalism”. The basic idea was that Scandinavia’s safety net discouraged entrepreneurship, while America’s relative lack of government support forced people to be risk-takers, and that this explained America’s greater rate of innovation. This is the kind of theory economists tend to like, because it emphasizes tradeoffs, and because it tells a story that allows economists to place themselves in the political center, charting the optimal middle path between the kind-hearted Democrats who want to give out free stuff and the exacting Republicans who want to force people to work for their supper. But other economists and bloggers immediately started noting problems with the thesis—most importantly, the fact that the Nordic countries are generally more innovative than the U.S. by many measures. Those countries are small, so you don’t hear about their innovations as much, but they really punch above their weight. Acemoglu et al. were trying to explain a “fact” that didn’t really exist.

Noah Smith, Cutthroat capitalism vs. cuddly capitalism

in 2012, Daron Acemoglu, James Robinson, and Thierry Verdier came out with a paper about the different “varieties of capitalism”. The basic idea was that Scandinavia’s safety net discouraged entrepreneurship, while America’s relative lack of government support forced people to be risk-takers, and that this explained America’s greater rate of innovation. This is the kind of theory economists tend to like, because it emphasizes tradeoffs, and because it tells a story that allows economists to place themselves in the political center, charting the optimal middle path between the kind-hearted Democrats who want to give out free stuff and the exacting Republicans who want to force people to work for their supper. But other economists and bloggers immediately started noting problems with the thesis—most importantly, the fact that the Nordic countries are generally more innovative than the U.S. by many measures. Those countries are small, so you don’t hear about their innovations as much, but they really punch above their weight. Acemoglu et al. were trying to explain a “fact” that didn’t really exist.

Life on the Grid (part 1) - by Roger’s Bacon - Secretorum

To review: growing up in simplistic spatial environments and using GPS has given you brain damage and life has become a soul-crushing video game utterly devoid of mystery or adventure. We are trapped in the Grid like an insect in the spider’s web; vigorous struggle will only serve to entangle us further.

New Things Under the Sun is a living literature review on social science research about innovation. Articles come in two flavors:

claims: a narrow claim about innovation based on a synthesis of academic papers

arguments: a broad claim about innovation based on a synthesis of claims

There are also index pages, which group claim articles into topics, and provide a short description of what each is about.

The website is growing all the time as articles get added and updated: subscribe to the substack newsletter to learn what’s new.

New Things Under the Sun is created by Matt Clancy, research fellow at Open Philanthropy. You can learn more about this project on the about page.